오늘은 Kodex 미국S&P500TR ETF 에 대해 자세하게 알아보겠습니다.

1. Kodex 미국S&P500TR ETF 는 어떤 ETF 인가?

Kodex 미국S&P500TR ETF 는 미국 시장을 대표하는 대형주 500개 종목에 투자하는 ETF 입니다.

또한 배당금수익을 분배금으로 ETF 투자자에게 지급하지 않고, 대신 ETF 내부에 재투자하는 토탈리턴 ETF 입니다.

토탈리턴 ETF 이기때문에 ETF 이름 끝에 TR (Total Return) 이 붙어 있습니다.

추종지수는 S&P500 TR 현물 지수입니다.

현물 지수를 추종하기때문에 연금저축/퇴직연금 등 연금투자도 가능합니다.

이렇게 퇴직연금/개인연금 투자 가능하고, 배당금을 알아서 재투자하기때문에, 연금계좌에서 장기간 투자하기에 최적화된 ETF 라고 볼 수 있습니다.

그냥 미국 주식 시장에 장기 투자한다 생각하고 사놓고 잊어버려도 된다는 것이지요.

특히, 달러 환노출 상품입니다.

달러 환노출이란 말은, 달러가치에 그대로 연동되어 있다는 것입니다.

그렇기에 특히 금융위기 상황에서는 주가는 내려도 달러가치가 올라서 포트폴리오를 방어해주는 기능도 합니다.

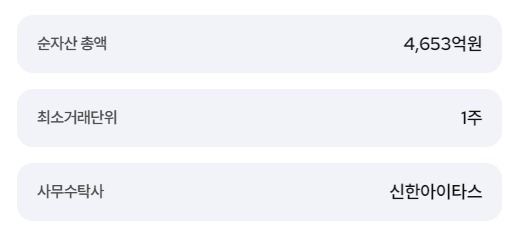

Kodex 미국S&P500TR ETF 기초정보.

Kodex 미국S&P500TR ETF 는 현재 순자산 총액 4,653억원 규모의 중대형 ETF 이며, 2021년 상장 후 현재까지 주식시장에서 활발히 거래되고 있습니다.

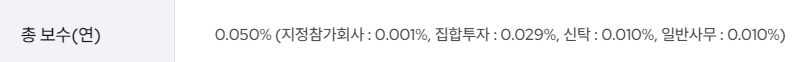

또한, ETF 장기투자시 중요하게 확인해야 하는 비용인 총보수의 경우, Kodex 미국S&P500TR ETF 는 연 0.05% 입니다.

이 정도면 정말 낮은 수수료라고 볼 수 있겠습니다.

ETF 에 장기투자할 경우에는 Kodex 미국S&P500TR ETF 와 유사한 ETF 와 연간 총보수를 비교하여 비교적 저렴한 ETF 를 고르는 것도 필요합니다.

그런데 이미 너무 낮은 수수료라 굳이 더 비교할 필요가 있나 싶겠네요.

물론, Kodex 미국S&P500TR ETF 와 다른 유사 ETF 를 비교할 경우 Kodex 미국S&P500TR ETF 의 총보수 만을 기준으로 선택을 해야한다는 것은 아니며, Kodex 미국S&P500TR ETF 와 비교시 시장에서 충분히 거래가 잘 될 수 있는 거래량이 유지되는지, ETF 운용사가 Kodex 미국S&P500TR ETF 운용사보다 믿을 수 있는지 등을 보고 종합적으로 선택하면 됩니다.

(근데 코덱스보다 더 믿을만한데가... 미래에셋의 타이거 정도라서...)

2. Kodex 미국S&P500TR ETF 의 분배금, 세금 및 수익률은 어떻게 되는가?

Kodex 미국S&P500TR ETF 의 분배금은 앞서 말씀드린 것처럼 지급하지 않습니다.

배당금을 재투자하는 토탈리턴 ETF 이기때문입니다.

Kodex 미국S&P500TR ETF 의 매매차익에 대해서는 15.4%의 배당소득세가 과세됩니다.

다른 이자, 배당소득과 합산액이 2천만원을 넘을 경우에는 금융소득종합과세 대상이 될 수 있습니다.

매매차익에 대한 세금이 면제되는 국내주식형이 아닌, 세금이 부과되는 해외주식형이기때문에, 배당소득세를 내는 것은 어쩔 수 없는 부분입니다.

그래도 연금계좌에서는 소득세 지급이 이연되는 효과가 있으니, 특히 연금계좌에서 투자하기에 유리하긴 합니다.

Kodex 미국S&P500TR ETF 기간별 수익률 현황.

아직 상장된지 오래되지 않아 장기수익률을 말하기는 애매합니다.

그냥 S&P500 수익률을 참조하시면 되겠습니다.

(최근 3개월 수익이 거의 10%에 가깝네요!)

3. Kodex 미국S&P500TR ETF 의 투자종목은 어떻게 구성되어 있는가?

Kodex 미국S&P500TR ETF 에서 비중이 가장 높은 종목은 애플(apple) 로서 약 6.75% 의 비중을 가지고 있습니다.

2등은 마이크로소프트네요.

Kodex 미국S&P500TR ETF 를 구성하는 전체 종목별 순위 및 비중에 대한 자세한 정보는 아래 Kodex 미국S&P500TR ETF 투자종목정보 세부현황(PDF) 를 참조하시기 바랍니다.

Kodex 미국S&P500TR ETF 투자종목정보 (PDF).

| Kodex 미국S&P500TR 투자종목정보(PDF) | ||

| 2023/03/31 | ||

| 번호 | 종목명 | 비중(%) |

| 1 | 설정현금액 | 0.00% |

| 2 | 원화현금 | 0.00% |

| 3 | APPLE Inc | 6.75% |

| 4 | MICROSOFT | 5.90% |

| 5 | Emini S&P500 FUT(ES) 2023 06 | 5.89% |

| 6 | Amazon.com Inc | 2.52% |

| 7 | NVIDIA Corp | 1.87% |

| 8 | ALPHABET INC-CL A | 1.71% |

| 9 | BERKSHIRE HATHWAY CL B ORD. | 1.55% |

| 10 | ALPHABET INC-CL C | 1.49% |

| 11 | TESLA MOTORS | 1.47% |

| 12 | Meta Platforms Inc-CL A | 1.29% |

| 13 | EXXON MOBIL CORP | 1.27% |

| 14 | UNITEDHEALTH GROUP INC | 1.23% |

| 15 | JOHNSON & JOHNSON | 1.13% |

| 16 | JPMORGAN CHASE & CO | 1.07% |

| 17 | VISA INC-CLASS A SHARES | 1.02% |

| 18 | PROCTER & GAMBLE CO/THE | 0.98% |

| 19 | MASTERCARD INC-CLASS A | 0.86% |

| 20 | HOME DEPOT INC | 0.82% |

| 21 | CHEVRON CORP | 0.81% |

| 22 | ABBVIE INC | 0.79% |

| 23 | MERCK & CO. INC. | 0.75% |

| 24 | ELI LILLY & CO | 0.75% |

| 25 | BROADCOM LTD | 0.74% |

| 26 | PEPSICO INC | 0.70% |

| 27 | COCA-COLA CO/THE | 0.68% |

| 28 | PFIZER INC | 0.64% |

| 29 | COSTCO WHOLESALE CORP | 0.62% |

| 30 | THERMO FISHER SCIENTIFIC INC | 0.62% |

| 31 | CISCO SYSTEMS INC | 0.59% |

| 32 | MCDONALD'S CORP | 0.57% |

| 33 | WAL-MART STORES INC | 0.57% |

| 34 | BANK OF AMERICA CORP | 0.57% |

| 35 | SALESFORCE INC | 0.56% |

| 36 | WALT DISNEY CO/THE | 0.50% |

| 37 | ACCENTURE PLC-CL A | 0.50% |

| 38 | Adobe Inc | 0.49% |

| 39 | LINDE PLC | 0.49% |

| 40 | ABBOTT LABORATORIES | 0.49% |

| 41 | TEXAS INSTRUMENTS | 0.46% |

| 42 | DANAHER CORP | 0.46% |

| 43 | VERIZON COMMUNICATIONS INC | 0.46% |

| 44 | COMCAST CORP | 0.44% |

| 45 | ADVANCED MICRO DEVICES | 0.44% |

| 46 | NEXTERA ENERGY INC | 0.43% |

| 47 | NIKE INC -CL B | 0.42% |

| 48 | NETFLIX | 0.42% |

| 49 | PHILIP MORRIS INTERNATIONAL | 0.41% |

| 50 | BRISTOL-MYERS SQUIBB CO | 0.41% |

| 51 | WELLS FARGO & CO | 0.41% |

| 52 | RAYTHEON TECHNOLOGIES CORP | 0.40% |

| 53 | UNITED PARCEL SERVICE-CL B | 0.39% |

| 54 | QUALCOMM Inc | 0.39% |

| 55 | ORACLE | 0.39% |

| 56 | AT&T INC | 0.38% |

| 57 | INTEL Corp | 0.37% |

| 58 | AMGEN INC | 0.36% |

| 59 | HONEYWELL INTERNATIONAL INC | 0.36% |

| 60 | CONOCOPHILLIPS | 0.34% |

| 61 | UNION PACIFIC CORP | 0.34% |

| 62 | INTUIT INC | 0.34% |

| 63 | INTL BUSINESS MACHINES CORP | 0.33% |

| 64 | BOEING CO/THE | 0.33% |

| 65 | CATERPILLAR INC | 0.33% |

| 66 | LOWE'S COS INC | 0.33% |

| 67 | STARBUCKS CORP | 0.33% |

| 68 | MORGAN STANLEY | 0.32% |

| 69 | S&P GLOBAL INC | 0.31% |

| 70 | PROLOGIS INC | 0.31% |

| 71 | ELEVANCE HEALTH | 0.31% |

| 72 | GOLDMAN SACHS GP Equity | 0.31% |

| 73 | DEERE & CO | 0.31% |

| 74 | LOCKHEED MARTIN CORP | 0.30% |

| 75 | MEDTRONIC PLC | 0.30% |

| 76 | GENERAL ELECTRIC CO | 0.29% |

| 77 | GILEAD SCIENCES INC | 0.29% |

| 78 | APPLIED MATERIALS INC | 0.29% |

| 79 | BLACKROCK INC | 0.28% |

| 80 | AMERICAN EXPRESS CO | 0.27% |

| 81 | ANALOG DEVICES | 0.27% |

| 82 | MONDELEZ INTERNATIONAL | 0.27% |

| 83 | CVS HEALTH CORP | 0.27% |

| 84 | STRYKER CORP | 0.27% |

| 85 | AMERICAN TOWER CORP | 0.26% |

| 86 | AUTOMATIC DATA PROCESSING | 0.26% |

| 87 | CITIGROUP INC | 0.25% |

| 88 | SERVICENOW INC | 0.25% |

| 89 | TJX COMPANIES INC | 0.25% |

| 90 | REGENERON PHARM | 0.25% |

| 91 | Intuitive Surgical Inc | 0.25% |

| 92 | T-MOBILE US INC | 0.24% |

| 93 | PROGRESSIVE CORP | 0.24% |

| 94 | SCHWAB (CHARLES) CORP | 0.24% |

| 95 | PAYPAL HOLDINGS INC | 0.24% |

| 96 | MARSH & MCLENNAN COS | 0.23% |

| 97 | Vertex Pharmaceuticals Inc | 0.23% |

| 98 | CHUBB LTD | 0.23% |

| 99 | ALTRIA GROUP INC | 0.22% |

| 100 | ZOETIS INC | 0.21% |

| 101 | CIGNA CORP | 0.21% |

| 102 | SOUTHERN CO/THE | 0.21% |

| 103 | DUKE ENERGY CORP | 0.21% |

| 104 | TARGET CORP | 0.21% |

| 105 | Fiserv Inc | 0.20% |

| 106 | BOSTON SCIENTIFIC CORP | 0.20% |

| 107 | LAM RESEARCH | 0.20% |

| 108 | MICRON TECH | 0.20% |

| 109 | SCHLUMBERGER LTD | 0.20% |

| 110 | BECTON DICKINSON AND CO | 0.19% |

| 111 | CME GROUP INC | 0.19% |

| 112 | EATON CORP PLC | 0.19% |

| 113 | ILLINOIS TOOL WORKS | 0.19% |

| 114 | NORTHROP GRUMMAN CORP | 0.19% |

| 115 | EOG RESOURCES INC | 0.19% |

| 116 | EQUINIX | 0.18% |

| 117 | AON PLC | 0.18% |

| 118 | CSX CORP | 0.18% |

| 119 | COLGATE-PALMOLIVE CO | 0.18% |

| 120 | AIR PRODUCTS & CHEMICALS INC | 0.17% |

| 121 | MARATHON PETROLEUM CORP | 0.17% |

| 122 | HUMANA INC | 0.17% |

| 123 | Activision Blizzard Inc | 0.17% |

| 124 | WASTE MANAGEMENT INC | 0.16% |

| 125 | SYNOPSYS INC | 0.16% |

| 126 | 3M CO | 0.16% |

| 127 | INTERCONTINENTAL EXCHANGE IN | 0.16% |

| 128 | ESTEE LAUDER COMPANIES-CL A | 0.16% |

| 129 | CROWN CASTLE Inc | 0.16% |

| 130 | Cadence Design Systems Inc | 0.16% |

| 131 | FREEPORT-MCMORAN INC | 0.16% |

| 132 | HCA HOLDINGS INC | 0.15% |

| 133 | KLA Corp | 0.15% |

| 134 | VALERO ENERGY CORP | 0.15% |

| 135 | O'REILLY AUTOMOTIVE | 0.15% |

| 136 | FEDEX CORP | 0.15% |

| 137 | PNC FINANCIAL SERVICES GROUP | 0.15% |

| 138 | GENERAL DYNAMICS CORP | 0.14% |

| 139 | SHERWIN-WILLIAMS CO/THE | 0.14% |

| 140 | US BANCORP | 0.14% |

| 141 | EDWARDS LIFESCIENCES CORP | 0.14% |

| 142 | GENERAL MILLS INC | 0.14% |

| 143 | GENERAL MOTORS CO | 0.14% |

| 144 | MODERNA INC | 0.14% |

| 145 | MCKESSON CORP | 0.14% |

| 146 | EMERSON ELECTRIC CO | 0.14% |

| 147 | PIONEER NATURAL RESOURCES CO | 0.14% |

| 148 | AMPHENOL CORP-CL A | 0.13% |

| 149 | NORFOLK SOUTHERN CORP | 0.13% |

| 150 | FORD MOTOR CO | 0.13% |

| 151 | MOODY'S CORP | 0.13% |

| 152 | PHILLIPS 66 | 0.13% |

| 153 | SEMPRA ENERGY | 0.13% |

| 154 | DOLLAR GENERAL CORP | 0.13% |

| 155 | NXP SEMICONDUCTORS NV | 0.13% |

| 156 | DOMINION RESOURCES INC/VA | 0.13% |

| 157 | AMERICAN ELECTRIC POWER | 0.13% |

| 158 | MOTOROLA SOLUTIONS INC | 0.13% |

| 159 | ROPER TECHNOLOGIES INC | 0.13% |

| 160 | PUBLIC STORAGE | 0.13% |

| 161 | TRUIST FINANCIAL CORP | 0.13% |

| 162 | OCCIDENTAL PETROLEUM CORP | 0.13% |

| 163 | KIMBERLY-CLARK CORP | 0.13% |

| 164 | MICROCHIP TECHNOLOGY INC | 0.13% |

| 165 | MSCI INC | 0.12% |

| 166 | DEXCOM | 0.12% |

| 167 | MARRIOTT INTERNATIONAL -CL A | 0.12% |

| 168 | ARCHER-DANIELS-MIDLAND CO | 0.12% |

| 169 | AUTODESK Inc | 0.12% |

| 170 | PARKER HANNIFIN CORP | 0.12% |

| 171 | CORTEVA | 0.12% |

| 172 | Trane Technologies plc | 0.12% |

| 173 | FORTINET INC | 0.12% |

| 174 | JOHNSON CONTROLS INT | 0.12% |

| 175 | EXELON CORP | 0.12% |

| 176 | IDEXX LABORATORIES INC | 0.11% |

| 177 | TE CONNECTIVITY LTD | 0.11% |

| 178 | ARISTA NETWORKS | 0.11% |

| 179 | ECOLAB INC | 0.11% |

| 180 | Cintas Corp | 0.11% |

| 181 | ARTHUR J GALLAGHER & CO | 0.11% |

| 182 | MONSTER BEVERAGE CORP | 0.11% |

| 183 | AGILENT TECHNOLOGIES INC | 0.11% |

| 184 | BIOGEN | 0.11% |

| 185 | SYSCO CORP | 0.11% |

| 186 | TRAVELERS COS INC/THE | 0.11% |

| 187 | REALTY INCOME CORP | 0.11% |

| 188 | Newmont Corp | 0.11% |

| 189 | TRANSDIGM GROUP INC | 0.11% |

| 190 | NUCOR | 0.11% |

| 191 | CARRIER GLOBAL CORP | 0.11% |

| 192 | DOW Inc | 0.11% |

| 193 | PACCAR Inc | 0.11% |

| 194 | METLIFE INC | 0.11% |

| 195 | PAYCHEX INC | 0.11% |

| 196 | HERSHEY CO/THE | 0.10% |

| 197 | L3HARRIS TECHNOLOGIES | 0.10% |

| 198 | HESS CORP | 0.10% |

| 199 | CHARTER COMMUNICATIONS INC-A | 0.10% |

| 200 | XCEL ENERGY INC | 0.10% |

| 201 | CONSTELLATION BRANDS INC-A | 0.10% |

| 202 | HILTON WORLDWIDE HOLDINGS IN | 0.10% |

| 203 | AMERICAN INTERNATIONAL GROUP | 0.10% |

| 204 | AFLAC INC | 0.10% |

| 205 | YUM! BRANDS INC | 0.10% |

| 206 | CAPITAL ONE FINANCIAL CORP | 0.10% |

| 207 | IQVIA HOLDINGS | 0.10% |

| 208 | WILLIAMS COS INC | 0.10% |

| 209 | ROSS STORES INC | 0.10% |

| 210 | CENTENE CORP | 0.10% |

| 211 | ILLUMINA INC | 0.10% |

| 212 | SIMON PROPERTY GROUP INC | 0.10% |

| 213 | ON SEMICONDUCTOR | 0.10% |

| 214 | OTIS WORLDWIDE CORP | 0.10% |

| 215 | KINDER MORGAN INC | 0.10% |

| 216 | CONSOLIDATED EDISON INC | 0.10% |

| 217 | BANK OF NEW YORK MELLON CORP | 0.09% |

| 218 | WELLTOWER INC | 0.09% |

| 219 | CUMMINS INC | 0.09% |

| 220 | ROCKWELL AUTOMATION INC | 0.09% |

| 221 | AMETEK INC | 0.09% |

| 222 | DEVON ENERGY CORP | 0.09% |

| 223 | DUPONT DE NEMOURS | 0.09% |

| 224 | WARNER BROS DISCOVERY INC | 0.09% |

| 225 | KROGER CO | 0.09% |

| 226 | VICI PROPERTIES INC | 0.09% |

| 227 | COPART | 0.09% |

| 228 | AMERIPRISE FINANCIAL INC | 0.09% |

| 229 | RESMED INC | 0.09% |

| 230 | Electronic Arts Inc | 0.09% |

| 231 | KRAFT HEINZ CO/THE | 0.09% |

| 232 | PUBLIC SERVICE ENTERPRISE GP | 0.09% |

| 233 | FIDELITY NATIONAL INFO SERV | 0.09% |

| 234 | WW GRAINGER INC | 0.09% |

| 235 | COGNIZANT TECH SOLUTIONS-A | 0.09% |

| 236 | FASTENAL CO | 0.09% |

| 237 | PPG INDUSTRIES INC | 0.09% |

| 238 | KEURIG DR PEPPER | 0.08% |

| 239 | DR HORTON INC | 0.08% |

| 240 | OLD DOMINION FREIGHT LINE | 0.08% |

| 241 | PRUDENTIAL FINANCIAL INC | 0.08% |

| 242 | VERISK ANALYTI | 0.08% |

| 243 | WEC ENERGY GROUP INC | 0.08% |

| 244 | APTIV PLC | 0.08% |

| 245 | DOLLAR TREE INC | 0.08% |

| 246 | ALLSTATE CORP | 0.08% |

| 247 | GE HealthCare Technologies Inc | 0.08% |

| 248 | BAKER HUGHES A GE | 0.08% |

| 249 | HALLIBURTON CO | 0.08% |

| 250 | KEYSIGHT TECH | 0.08% |

| 251 | ANSYS INC | 0.08% |

| 252 | AMERICAN WATER WORKS CO INC | 0.08% |

| 253 | Enphase Energy Inc | 0.08% |

| 254 | COSTAR GROUP | 0.08% |

| 255 | ONEOK INC | 0.08% |

| 256 | SBA COMM | 0.08% |

| 257 | REPUBLIC SERVICES INC | 0.08% |

| 258 | GLOBAL PAYMENTS INC | 0.08% |

| 259 | EVERSOURCE ENERGY | 0.08% |

| 260 | UNITED RENTALS INC | 0.08% |

| 261 | EDISON INTERNATIONAL | 0.08% |

| 262 | ULTA SALON COSMETICS & FRAGR | 0.08% |

| 263 | ZIMMER BIOMET HOLDINGS INC | 0.08% |

| 264 | DIGITAL REALTY TRUST INC | 0.07% |

| 265 | STATE STREET CORP | 0.07% |

| 266 | ALBEMARLE CORP | 0.07% |

| 267 | CORNING INC | 0.07% |

| 268 | DISCOVER FINANCIAL SERVICES | 0.07% |

| 269 | LENNAR CORP-A | 0.07% |

| 270 | AMERISOURCEBERGEN CORP | 0.07% |

| 271 | TRACTOR SUPPLY COMPANY | 0.07% |

| 272 | P G & E CORP | 0.07% |

| 273 | CDW CORP/DE | 0.07% |

| 274 | GARTNER INC | 0.07% |

| 275 | WEST PHARMACEUTICAL SERVICES | 0.07% |

| 276 | ARCH CAPITAL GROUP LTD | 0.07% |

| 277 | CONSTELLATION ENERGY | 0.07% |

| 278 | T ROWE PRICE GROUP INC | 0.07% |

| 279 | WILLIS TOWERS WATSON PLC | 0.07% |

| 280 | HP INC | 0.07% |

| 281 | WALGREENS BOOTS ALLIANCE INC | 0.07% |

| 282 | DIAMONDBACK ENERGY INC | 0.07% |

| 283 | EQUIFAX INC | 0.07% |

| 284 | FORTIVE CORP | 0.07% |

| 285 | Quanta Services Inc | 0.07% |

| 286 | EBAY INC | 0.07% |

| 287 | LYONDELLBASELL INDU-CL A | 0.07% |

| 288 | INGERSOLL-RAND Inc | 0.06% |

| 289 | GENUINE PARTS CO | 0.06% |

| 290 | INTL FLAVORS & FRAGRANCES | 0.06% |

| 291 | AVALONBAY COMMUNITIES INC | 0.06% |

| 292 | VULCAN MATERIALS CO | 0.06% |

| 293 | ALIGN TECHNOLOGY | 0.06% |

| 294 | AMEREN CORPORATION | 0.06% |

| 295 | MONOLITHIC POWER SYSTEMS INC | 0.06% |

| 296 | CBRE GROUP INC - A | 0.06% |

| 297 | HARTFORD FINANCIAL SVCS GRP | 0.06% |

| 298 | INSULET CORP | 0.06% |

| 299 | MARTIN MARIETTA MATERIALS | 0.06% |

| 300 | ENTERGY CORP | 0.06% |

| 301 | DELTA AIR LINES INC | 0.06% |

| 302 | FIRSTENERGY CORP | 0.06% |

| 303 | WEYERHAEUSER CO | 0.06% |

| 304 | FIRST SOLAR INC | 0.06% |

| 305 | CHURCH & DWIGHT CO INC | 0.06% |

| 306 | DTE ENERGY COMPANY | 0.06% |

| 307 | EXTRA SPACE STORAGE INC | 0.06% |

| 308 | M & T BANK CORP | 0.06% |

| 309 | DOVER CORP | 0.06% |

| 310 | BAXTER INTERNATIONAL INC | 0.06% |

| 311 | MCCORMICK & CO-NON VTG SHRS | 0.06% |

| 312 | PPL CORP | 0.06% |

| 313 | TELEDYNE TECHNOLOGIES INC | 0.06% |

| 314 | HEWLETT PACKARD ENTERPRIS | 0.06% |

| 315 | LABORATORY CRP OF AMER HLDGS | 0.06% |

| 316 | EQUITY RESIDENTIAL | 0.06% |

| 317 | Hologic Inc | 0.06% |

| 318 | ALEXANDRIA REAL ESTATE EQUIT | 0.05% |

| 319 | CARDINAL HEALTH INC | 0.05% |

| 320 | CLOROX COMPANY | 0.05% |

| 321 | COTERRA ENERGY Inc | 0.05% |

| 322 | VeriSign Inc | 0.05% |

| 323 | DARDEN RESTAURANTS INC | 0.05% |

| 324 | SOUTHWEST AIRLINES CO | 0.05% |

| 325 | STERIS PLC | 0.05% |

| 326 | SKYWORKS SOLUTIONS INC | 0.05% |

| 327 | FIFTH THIRD BANCORP | 0.05% |

| 328 | TAKE-TWO INTERACTIVE SOFTWRE | 0.05% |

| 329 | STEEL DYNAMICS INC | 0.05% |

| 330 | CENTERPOINT ENERGY INC | 0.05% |

| 331 | OMNICOM GROUP | 0.05% |

| 332 | NASDAQ INC | 0.05% |

| 333 | XYLEM INC | 0.05% |

| 334 | NORTHERN TRUST CORP | 0.05% |

| 335 | RAYMOND JAMES FINANCIAL INC | 0.05% |

| 336 | WABTEC CORP | 0.05% |

| 337 | LAS VEGAS SANDS CORP | 0.05% |

| 338 | CONAGRA FOODS INC | 0.05% |

| 339 | WATERS CORP | 0.05% |

| 340 | CMS ENERGY CORP | 0.05% |

| 341 | COOPER COS INC/THE | 0.05% |

| 342 | FAIR ISAAC CORP | 0.05% |

| 343 | VENTAS INC | 0.05% |

| 344 | INVITATION HOMES | 0.05% |

| 345 | CINCINNATI FINANCIAL CORP | 0.05% |

| 346 | REGIONS FINANCIAL CORP | 0.05% |

| 347 | IDEX | 0.05% |

| 348 | KELLOGG CO | 0.05% |

| 349 | MID-AMERICA APARTMENT COMM | 0.05% |

| 350 | BALL CORP | 0.05% |

| 351 | BROADRIDGE FINANCIAL SOLUTIO | 0.05% |

| 352 | SJM | 0.05% |

| 353 | EXPEDITORS INTL WASH INC | 0.05% |

| 354 | TERADYNE INC | 0.05% |

| 355 | PRINCIPAL FINANCIAL GROUP | 0.05% |

| 356 | TYSON FOODS INC-CL A | 0.05% |

| 357 | EPAM SYSTEMS | 0.05% |

| 358 | AMCOR PLC | 0.05% |

| 359 | SOLAREDGE TECHNOLOGIES INC | 0.05% |

| 360 | PerkinElmer Inc | 0.05% |

| 361 | HUNTINGTON BANCSHARES INC | 0.05% |

| 362 | TARGA RESOURCES CORP | 0.05% |

| 363 | ATMOS ENERGY CORP | 0.05% |

| 364 | AES CORP | 0.04% |

| 365 | MOLINA HEALTHCAR | 0.04% |

| 366 | HOWMET AEROSPACE INC | 0.04% |

| 367 | MOSAIC CO/THE | 0.04% |

| 368 | QUEST DIAGNOSTICS INC | 0.04% |

| 369 | CITIZENS FINANCIAL GROUP | 0.04% |

| 370 | FLEETCOR TECHNOLOGIES INC | 0.04% |

| 371 | ZEBRA TECHNOLOGIES | 0.04% |

| 372 | FMC CORP | 0.04% |

| 373 | GARMIN LTD | 0.04% |

| 374 | MARATHON OIL CORP | 0.04% |

| 375 | IRON MOUNTAIN INC | 0.04% |

| 376 | LAMB WESTON HOLDINGS | 0.04% |

| 377 | BEST BUY CO INC | 0.04% |

| 378 | TEXTRON INC | 0.04% |

| 379 | JACOBS SOLUTIONS INC | 0.04% |

| 380 | BUNGE LTD | 0.04% |

| 381 | TYLER TECHNOLOGIES INC | 0.04% |

| 382 | HUNT (JB) TRANSPRT SVCS INC | 0.04% |

| 383 | United Airlines Holdings Inc | 0.04% |

| 384 | CF INDUSTRIES HOLDINGS INC | 0.04% |

| 385 | LKQ CORP | 0.04% |

| 386 | CBOE Holdings Inc | 0.04% |

| 387 | EXPEDIA INC | 0.04% |

| 388 | ROYAL CARIBBEAN CRUISES LTD | 0.04% |

| 389 | AVERY DENNISON CORP | 0.04% |

| 390 | PAYCOM SOFTWARE | 0.04% |

| 391 | EVERGY INC | 0.04% |

| 392 | INTERPUBLIC GROUP OF COS INC | 0.04% |

| 393 | MGM RESORTS INTE EQUITY | 0.04% |

| 394 | ETSY INC | 0.04% |

| 395 | NETAPP INC | 0.04% |

| 396 | BROWN & BROWN INC | 0.04% |

| 397 | ESSEX PROPERTY TRUST INC | 0.04% |

| 398 | ALLIANT ENERGY CORP | 0.04% |

| 399 | PTC INC | 0.04% |

| 400 | INCYTE CORP | 0.04% |

| 401 | PULTEGROUP INC | 0.04% |

| 402 | SNAP-ON INC | 0.04% |

| 403 | TRIMBLE NAVIGATION LTD | 0.04% |

| 404 | PACKAGING CORP OF AMERICA | 0.04% |

| 405 | WR BERKLEY CORP | 0.04% |

| 406 | LEIDOS HOLDINGS | 0.04% |

| 407 | SYNCHRONY FINANCIAL | 0.04% |

| 408 | INTERNATIONAL PAPER CO | 0.04% |

| 409 | SEAGATE TECHNOLOGY | 0.03% |

| 410 | UDR INC | 0.03% |

| 411 | Akamai Technologies Inc | 0.03% |

| 412 | CATALENT INC | 0.03% |

| 413 | KEYCORP | 0.03% |

| 414 | WESTERN DIGITAL | 0.03% |

| 415 | HEALTHPEAK PROPERTIES INC | 0.03% |

| 416 | NORDSON CORP | 0.03% |

| 417 | BROWN FORMAN CL B ORD. | 0.03% |

| 418 | VIATRIS Inc. | 0.03% |

| 419 | EQT CORP | 0.03% |

| 420 | APA CORPORATION | 0.03% |

| 421 | STANLEY BLACK & DECKER INC | 0.03% |

| 422 | KIMCO REALTY CORP | 0.03% |

| 423 | TELEFLEX INC | 0.03% |

| 424 | HORMEL FOODS CORP | 0.03% |

| 425 | CH Robinson Worldwide Inc | 0.03% |

| 426 | CAMDEN PROPERTY TRUST | 0.03% |

| 427 | BORGWARNER INC | 0.03% |

| 428 | HOST HOTELS & RESORTS INC | 0.03% |

| 429 | WYNN RESORTS LTD | 0.03% |

| 430 | NISOURCE INC | 0.03% |

| 431 | LOEWS CORP | 0.03% |

| 432 | MASCO CORP | 0.03% |

| 433 | CAMPBELL SOUP CO | 0.03% |

| 434 | MATCH GROUP INC | 0.03% |

| 435 | PARAMOUNT GLOBAL | 0.03% |

| 436 | JACK HENRY & ASSOCIATES | 0.03% |

| 437 | JUNIPER NETWORKS INC | 0.03% |

| 438 | Henry Schein Inc | 0.03% |

| 439 | Ceridian HCM Holdings Inc | 0.03% |

| 440 | CELANESE CORP-SERIES A | 0.03% |

| 441 | CHARLES RIVER LABORATORIES | 0.03% |

| 442 | QORVO INC | 0.03% |

| 443 | CARNIVAL CORP | 0.03% |

| 444 | TAPESTRY INC | 0.03% |

| 445 | GLOBE LIFE | 0.03% |

| 446 | FOX Corp Class A | 0.03% |

| 447 | EASTMAN CHEMICAL CO | 0.03% |

| 448 | MOLSON COORS BEVERAGE CO | 0.03% |

| 449 | LIVE NATION ENTERTAINMENT IN | 0.03% |

| 450 | CAESARS ENTERTAINMENT | 0.03% |

| 451 | NORTONLIFELOCK INC | 0.03% |

| 452 | CARMAX INC | 0.03% |

| 453 | AMERICAN AIRLINES GROUP INC | 0.03% |

| 454 | ALLEGION PLC | 0.03% |

| 455 | REGENCY CENTERS CORP | 0.03% |

| 456 | PINNACLE WEST CAPITAL | 0.03% |

| 457 | PENTAIR PLC | 0.03% |

| 458 | SMITH (A.O.) CORP | 0.02% |

| 459 | ROLLINS | 0.02% |

| 460 | F5 INC | 0.02% |

| 461 | BATH & BODY WORKS INC | 0.02% |

| 462 | ROBERT HALF INTL INC | 0.02% |

| 463 | DENTSPLY SIRONA INC | 0.02% |

| 464 | UNIVERSAL HEALTH SERVICES-B | 0.02% |

| 465 | NRG ENERGY INC | 0.02% |

| 466 | WESTROCK CO | 0.02% |

| 467 | BOSTON PROPERTIES INC | 0.02% |

| 468 | FRANKLIN RESOURCES INC | 0.02% |

| 469 | INVESCO LTD | 0.02% |

| 470 | VF CORP | 0.02% |

| 471 | GENERAC HOLDINGS INC | 0.02% |

| 472 | WHIRLPOOL CORP | 0.02% |

| 473 | ADVANCE AUTO PARTS INC | 0.02% |

| 474 | FEDERAL REALTY INVS TRUST | 0.02% |

| 475 | HASBRO INC | 0.02% |

| 476 | NEWS CORP-CL A | 0.02% |

| 477 | SEALED AIR CORP | 0.02% |

| 478 | ASSURANT INC | 0.02% |

| 479 | COMERICA INC | 0.02% |

| 480 | ORGANON & CO | 0.02% |

| 481 | DXC TECHNOLOGY | 0.02% |

| 482 | NORWEGIAN CRUISE LINE HOLDIN | 0.02% |

| 483 | ALASKA AIR GROUP INC | 0.01% |

| 484 | MOHAWK INDUSTRIES INC | 0.01% |

| 485 | RALPH LAUREN CORP | 0.01% |

| 486 | ZIONS BANCORPORATION | 0.01% |

| 487 | NEWELL BRANDS INC | 0.01% |

| 488 | DAVITA HEALTHCARE PARTNERS I | 0.01% |

| 489 | FOX Corp Class B | 0.01% |

| 490 | LINCOLN NATIONAL CORP | 0.01% |

| 491 | FIRST REPUBLIC BANK/CA | 0.01% |

| 492 | DISH Network Corp | 0.01% |

| 493 | News Corp | 0.01% |

'금융 투자 공부' 카테고리의 다른 글

| Kodex 미국나스닥100TR ETF 분배금, 세금, 수익률 및 투자종목 (코덱스 나스닥100) (0) | 2023.04.02 |

|---|---|

| Kodex 미국FANG플러스(H) ETF 분배금, 세금, 수익률 및 투자종목 (0) | 2023.04.02 |

| Kodex 코스닥 150 ETF 분배금, 세금, 수익률 및 투자종목 (0) | 2023.04.02 |

| Kodex 선진국MSCI World ETF 분배금, 세금, 수익률 및 투자종목 (0) | 2023.04.02 |

| Kodex 코스닥150선물 인버스 ETF 분배금, 세금, 수익률 및 투자종목 (0) | 2023.04.01 |